Nike, Inc.reported the following plant assets and intangible assets for the year ended May 31, 2022 - Brainly.com

Solved] Land P 800,000 Building Pl,500,000 Less: Accumulated depreciation 450,000 1,050,000 Equipment P 700,000 Less: | Course Hero

Explain and Apply Depreciation Methods to Allocate Capitalized Costs – Principles of Accounting, Volume 1: Financial Accounting

11 Property, Plant, and Equipment and Intangible Assets: Utilization and Impairment Chapter 11: Property, Plant, and Equipment and Intangible Assets: - ppt download

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

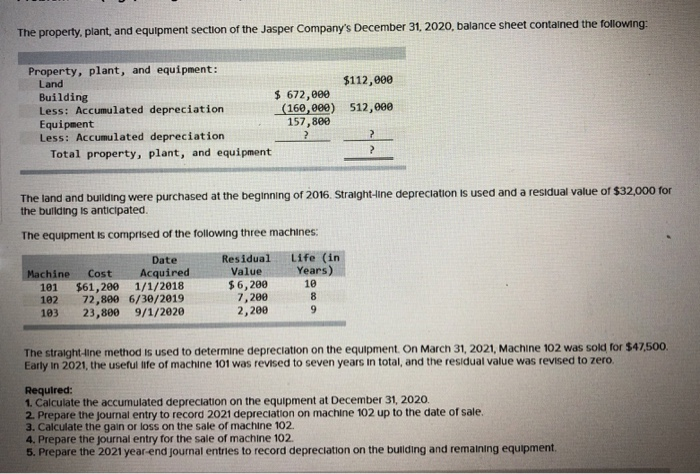

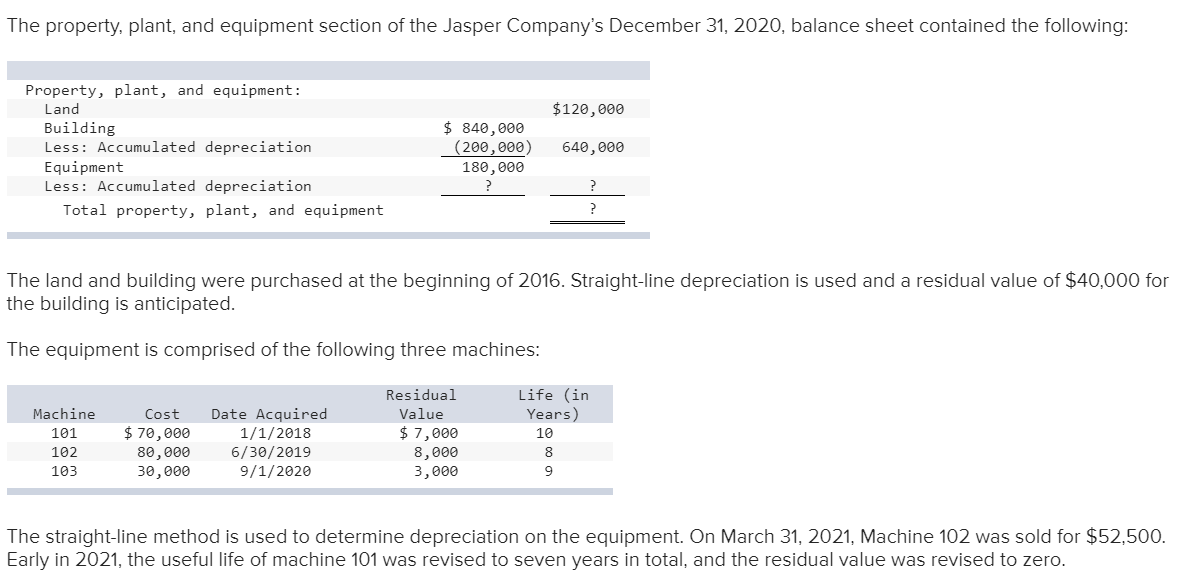

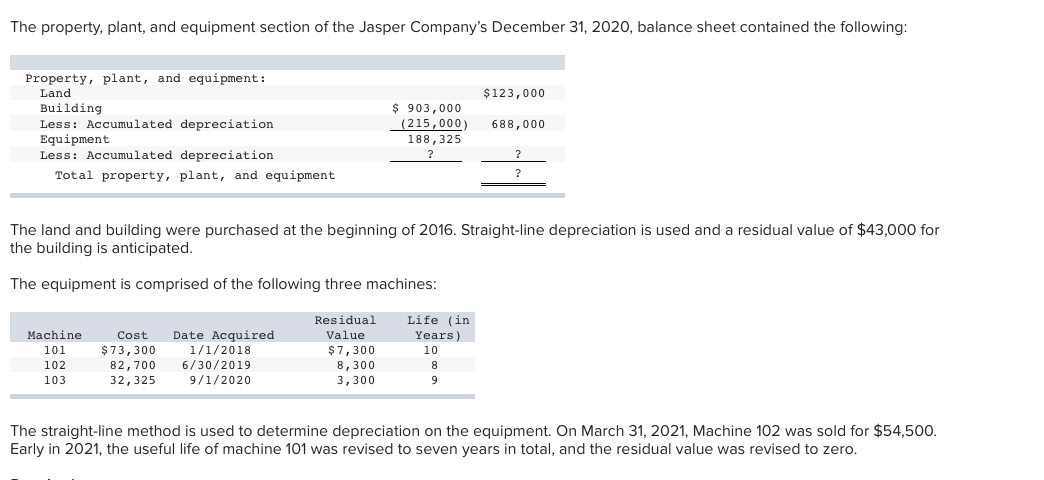

![Solved] The property, plant, and equipment section of the Jasper Company's D | SolutionInn Solved] The property, plant, and equipment section of the Jasper Company's D | SolutionInn](https://www.solutioninn.com/images/question_images/1569/4/2/3/5295d8b80a99b7ec1569406835083.jpg)